QUESTION 38

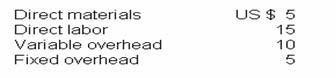

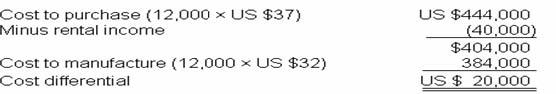

The ABC Company manufactures components for use in producing one of its finished products. When 12,000 units are produced, the full cost per unit is US $35, separated as follows: The XYZ Company has offered to sell 12,000 components to ABC for US $37 each. If ABC accepts the offer, some of the facilities currently being used to manufacture the components can be rented as warehouse space for US $40,000. However, US $3 of the fixed overhead currently applied to each component would have to be covered by ABC’s other products. What is the differential cost to the ABC Company of purchasing the components from the XYZ Company?

Differential incremental) cost is the difference in total cost between two decisions. The relevant costs do not include unavoidable costs, such as the US $3 of fixed overhead. It would cost ABC an additional US $20,000 to purchase, rather than manufacture, the components.

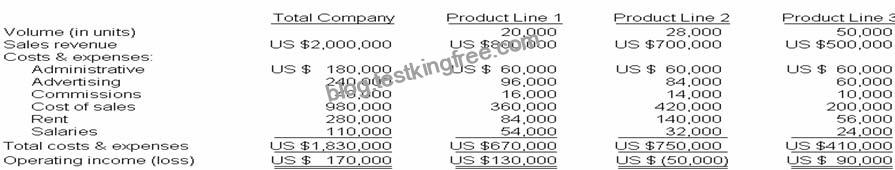

The segmented income statement for a retail company with three product lines is presented below:

The company buys the goods in the three product lines directly from manufacturers’ representatives. Each product line is directed by a manager whose salary is included in the administrative expenses. Administrative expenses are allocated to the three product lines equally because the administration is spread evenly among the three product lines.

Salaries represent payments to the workers in each product line and therefore are traceable costs of each product line. Advertising promotes the entire company rather than the individual product lines. As a result, the advertising is allocated to the three product lines in proportion to the sales revenue. Commissions are paid to the salespersons in each product line based on 2% of gross sales. Rent represents the cost of the retail store and warehouse under a lease agreement with 5 years remaining. The product lines share the retail and warehouse space, and the rent is allocated to the three product lines based on the square footage occupied by each of the product lines.